How to save $100s on your monthly mortgage payment

When buying a home on Whidbey Island

Contributed by Si Fisher

As a Whidbey Island homebuyer, you may be searching for affordable housing and having a rough go at it. Mortgage rates are much higher now than they were last year, and this could mean several hundred dollars more a month when looking at a potential mortgage in your desired price point.

Luckily, today I am going to share with you a program that can help reduce your monthly mortgage payment by hundreds of dollars.

At this point you are probably thinking, “What wizardry is this?” Well, the magic all has to do with mortgage buydowns, and more specifically I want to talk about what some sellers are doing to make their homes more appealing and affordable to potential buyers looking on Whidbey Island.

What Is A Buydown On A Mortgage?

Most lenders when originating a loan will have an option for the borrower to purchase something called discount points (also referred to as mortgage points, or prepaid interest points). Essentially it is a prepaid fee that allows you to buy down the interest rate on your loan and thereby lower your monthly payment for the entire duration of the loan.

In a different type of buydown, the points purchased at the start of the loan lower the interest rate for a specific period of time. As mentioned above we are now seeing sellers offer to pay for these shorter term buydowns to make their home more affordable to a larger number of buyers. The most common one we are seeing now is called the 2/1 buydown.

Contact a local expert about financing your next home

The 2/1 Mortgage Buydown Program

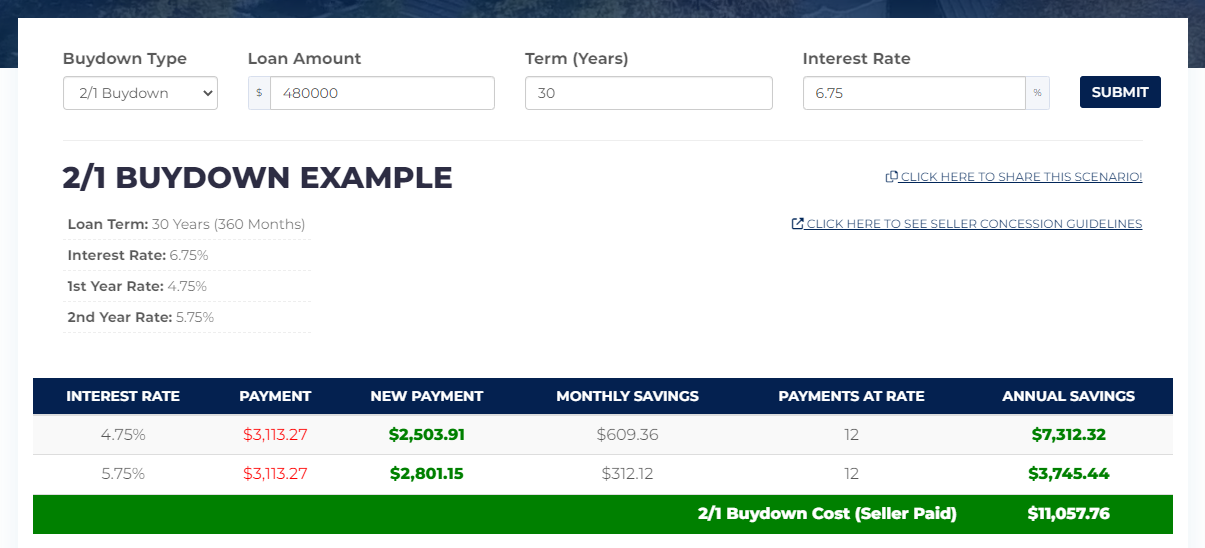

The 2/1 Mortgage Buydown allows a borrower to lock in an interest rate 2% lower than the current rate for the first year, and then 1% lower for the second year of the loan. After that the loan defaults back to what the current rate was at the time of the loan origination. Let’s look at an example of how this works.

Let’s say you are looking at a home for $600,000. You plan on making a 20% down payment, leaving $480,000 that needs to be financed. Observe the chart below:

$609 dollars/month savings for the borrower during the first year!!!

Okay let’s break it down. If a borrower was financing their $480K loan at today’s rate of about 6.75% their monthly payment would be $3,113.27/month. When using this 2/1 buydown program their rate drops to 4.75% for the first year, and 5.75% for the second year. This lowers the monthly payments during that time to $2,503.91 and $2,801.15 respectively. After that point your loan goes back to what the original rate would have been if you were not taking advantage of this program. AND, should the interest rates fall during the course of the first two years, you can always refinance to the new lower rate after the buydown period ends.

One additional thing to note is that the borrower would still need to qualify for the loan at the current interest rate, not the buydown rate.

The best part about this is that everybody wins! The seller gets more potential buyers interested in their home (this can be a lot more enticing and more cost effective than a price reduction), and the buyer gets two years of reduced monthly payments. If both parties agree, the seller would then pay for the buydown through escrow when the home sale closes. In the example above the seller would pay around $10K depending on a variety of factors. Presto chango!

This is just another tool to put in your tool kit and another reason to work with a professional who has a full set of tools!

Article contributed by:

Si Fisher

Should I wait for mortgage rates to go down?

Contributed by Si Fisher

Homebuyers, are you ready to take the next step but feeling unsure with rising interest rates? Mortgage rates have indeed increased significantly over this past year. But don’t worry because Windermere Whidbey is here for all your needs! We've compiled a wealth of information that can help you make an informed decision when it comes to buying a home in 2022 and beyond - just keep reading below:

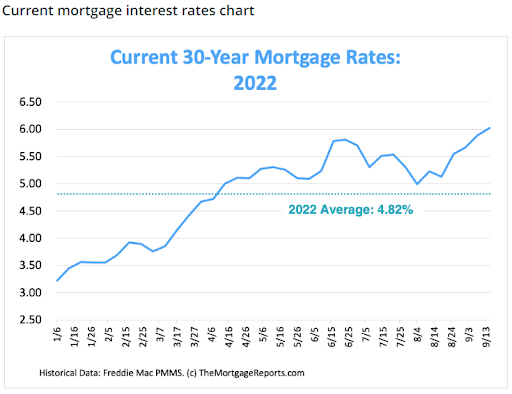

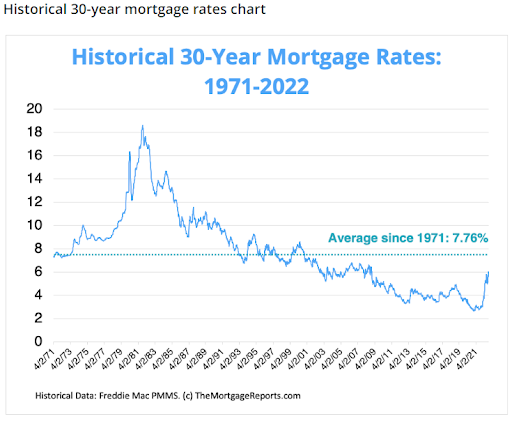

First, let’s look at some historic mortgage rate data to put things in perspective. During the Covid pandemic, mortgage interest rates reached all-time lows in 2020 and 2021. Mortgage rates were pushed below 3% and were kept there thanks to emergency measures taken by the Federal Reserve. However, if you look at the chart below you will see that throughout 2022 we have seen interest rates gradually rise.

While this may appear scary, I want to provide one additional piece of information that will give you even more perspective. Examine the chart below:

The graph above certainly tells a different story. Despite recent increases, 30-year mortgage rates now are still below the historical norm. With that being said, a 3% rate does seem a lot more appealing than a 6% or higher rate. Especially when you look at how this will affect your purchasing power.

Contact a local expert about financing your next home

How Will Rising Mortgage Rates Impact a Home Buyer’s Purchasing Power?

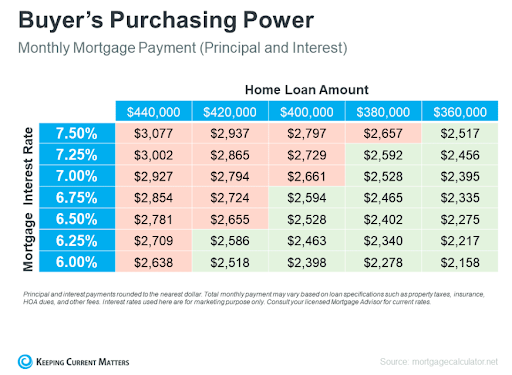

Let's say you want to purchase a property for $400,000, and you want to keep your monthly payment at or below $2600. Here is how your spending power may alter if mortgage rates rise, see the chart below.

Are Mortgage Interest Rates Going to Continue to Rise or Go Back Down?

The short answer is that the direction interest rates will go is nearly impossible to predict. According to most experts on the subject, rates may continue to rise for a while as the FED attempts to get inflation under control. However, if we see the rising interest rates start to cause a recession, they might lower. Again, nothing is certain on this front and the rates are dependent on too many frequently changing factors to have a guaranteed prediction.

Conclusion: Should you wait for mortgage rates to go back down before purchasing a home?

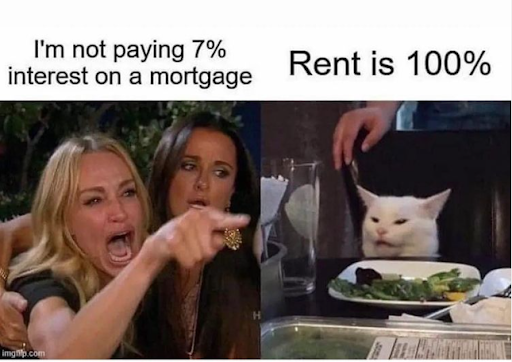

If you are a renter who is currently trying to decide if you want to purchase a home or wait on changing rates, I just want to share one image with you:

In essence, it is accurate to say that the cost of purchasing a property has increased since last year. The distinction is that homeownership also involves building equity over time, which will increase your net worth.

It makes little sense for a borrower to attempt to time their purchase based solely on interest rates in this market. Regardless of current interest rates, our best recommendation is to wait to purchase until you are financially prepared and able to afford the property you desire.

Keep in mind that your mortgage rate won't be fixed in stone. Homeowners can always refinance later if rates drop sufficiently to reduce costs.

Final Thoughts:

Situations vary from person to person. Working with a real estate adviser to weigh your options is what can help you make the best choice possible, and it just so happens we have an office full of highly trained real estate professionals. Don’t hesitate to reach out if you have any questions about the buying or selling process.

Article contributed by:

Si Fisher

What Is an Adjustable-Rate Mortgage (ARM)?

Contributed by Si Fisher

It’s no secret that interest rates have continued to rise, and are now substantially higher than even just 3 months ago. For this reason, different loan products are coming back into “fashion”. As a buyer it is important to understand the options available to you when financing your home. That’s where we come in! In this edition of “Home Buyer Education” we are going to answer the question “What Is an Adjustable-Rate Mortgage (ARM)?”

What Is an Adjustable-Rate Mortgage (ARM)?

An adjustable-rate mortgage, or ARM, is a type of home loan that starts with a fixed interest rate for a specified period of time, typically five years. After that initial period ends, the interest rate will adjust annually based on current market conditions. Because the interest rate can change over time, your monthly payment may go up or down.

An ARM can be a good option if you plan to own your home for only a few years, since it typically offers lower interest rates than a fixed-rate mortgage. It can also be a good choice if you expect your income to increase in the coming years, which will help you afford any potential increases in your monthly payment. However, if market conditions cause interest rates to rise sharply after the initial fixed-rate period ends, you could end up paying more than you would with a fixed-rate mortgage.

Be sure to ask your lender about how often and by how much the interest rate on an ARM can change. You should also make sure you understand how the payments will change if rates rise or fall. That way, you can be sure an ARM is the right choice for you before you apply for a loan.

Contact a local expert about financing your next home

Different Types of Adjustable-Rate Mortgages (ARMs)

Payment-Option ARM:

With a payment-option ARM, you will have the freedom to select your monthly payments, including interest-only payments and minimum payments that don't cover interest. When interest rates rise, these loan options can potentially land homebuyers in trouble.

Interest-Only ARM:

In an interest-only ARM, you only make interest payments only for a certain amount of time before beginning to make principle payments as well. When the delayed principal payments are added in, your payments will increase. Also the longer the introductory period is, the more this increase will be.

Hybrid ARM:

A hybrid ARM begins with a fixed-rate introduction phase and then transitions to an adjustable-rate period, as previously mentioned. A hybrid ARM's fixed-rate phase typically lasts three to ten years, and during the adjustable-rate period, rates vary at a predetermined frequency, such as once every six months or once a year.

Pros and Cons of an Adjustable-Rate Mortgage (ARM)

Pros

- You can budget and save money thanks to the low introductory rate before the adjustable-rate term begins.

- If you intend to sell the property in the near future, you can use the sale profits to settle your mortgage before the fixed-rate period expires.

- Your interest rate and monthly payments can go down if the index declines over time.

- You can budget and save money thanks to the low introductory rate before the adjustable-rate term begins.

Cons

- A fixed-rate mortgage can be a preferable choice if you want to reside in the house for an extended period of time.

- Your monthly payments can become unmanageable if you don't know how interest rates will change.

- An ARM makes financial planning more challenging since you can never predict what your monthly payments will be from one year to the next.

- A fixed-rate mortgage can be a preferable choice if you want to reside in the house for an extended period of time.

Article contributed by:

Si Fisher

How to Install Laminate Flooring:

Written by: Anita Johnston

How many times have you thought “I can install laminate flooring” or “I wish I could do that?” Flooring is one of those renovation projects that allure newbies most often. After mastering the skill of installing your own floor it can liberate the home owner which can be good and bad for a home.

I have walked through many homes and within a second I can pick out a home owner renovation project. From spaces between cabinets that weren’t properly attached together or gaps that weren’t perfectly filled with a filler pencil. And flooring………. I have seen the worst flooring jobs while touring houses for sale. A new floor can add great value to a home. But an improperly installed floor can actually deduct value from a home. I just saw this recently with a home that the appraiser specifically noted the poor flooring installation and downgraded the value of the home.

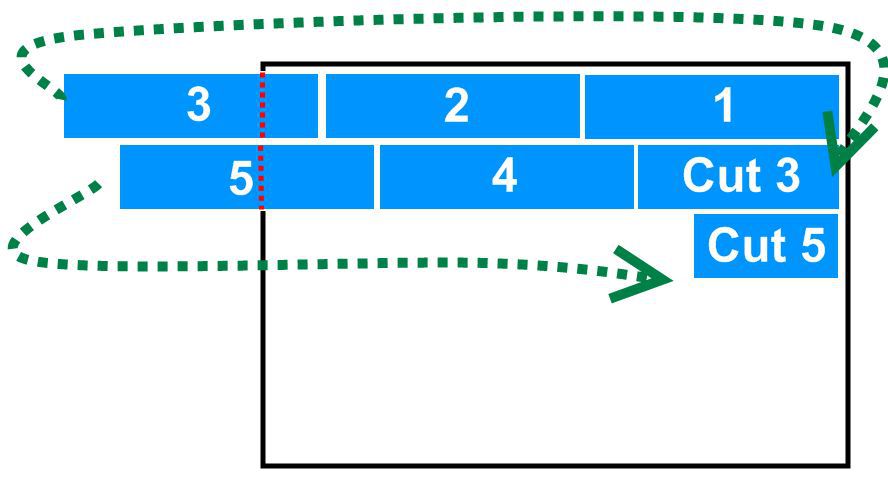

There’s several things to keep in mind when installing flooring. Prepping the floor is a must. If you’ve removed carpet then you definitely had to endure the tedious task of removing staples that was holding down the carpet pad.

Sweeping the floor to make double sure that there’s nothing sticking up that won’t allow the floor to lie perfectly flat and level. Second you need to decide where to start. If it’s just one room that’s easier. You simply start running your flooring parallel to the entrance. Once you lay out your first row you will then take your cut board and lay it in place to start your next row. There should never be less than 4″ from the end of one board to and other ends the row before or after. You should tap the boards together until they click together and all gaps are gone.